We’ve been teased with a few days of 50 degree temps and bright sunshine which has sparked a yearning to break out the golf clubs! If you’re curious about the current memberships for the Vail Valley’s private golf clubs, scroll down to see the latest information on availability and dues. Despite the recent warm temps, Mother Nature has decided that winter should stay for a little while longer. Over the last couple of days, Vail Mountain has broken the 300″ mark on the mountain with more on the way which goes to show why March is often one of the snowiest months of the year. Speaking of skiing, Jade attended the Special Olympics state ski races in Copper Mountain this month and walked away with both a Gold and Silver medal, we’re so proud!

It may be a broken record at this point, but low inventory continues to be the name of the game! However, we are seeing progress on multiple new development projects across the valley that brings a sudden influx of inventory to market when new phases are released. Check out my video here in the sales office of the Frontgate | Avon development which is just a stone’s throw away from the gates of Beaver Creek. I’m so excited to have the model unit under contract with my buyer just as Phase II was released. Since March 1st, four units have gone under contract ranging from $2,050,000 to $$3,975,000. This is an amenity-rich development, so reach out for more information or to schedule a private tour!

If you’re curious about a specific neighborhood, listing or dinner spot, remember to pose a question to “Ask Andie” – and catch my video responses that are posted on my social media. You can also send me a quick note here – [email protected].

Until next month!

Connecting Lifestyle With Community

Private Golf Club Memberships

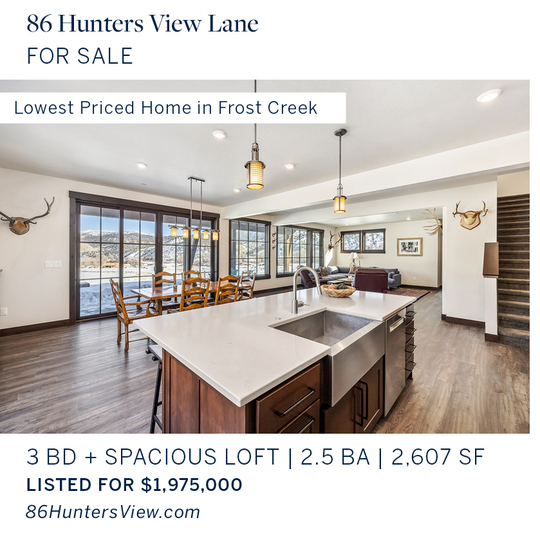

FROST CREEK

Eagle, Colorado

Accepting new members.

Local Golf Membership

Annual Dues – $11,640

Initiation Fee – $100,000

National Golf Membership

Annual Dues – $9,040

Initiation Fee – $100,000

Resident Social Membership

Annual Dues – $5,000

Initiation Fee – $65,000

Available only with purchase of Frost Creek Developer Owned or Resale Home/Homesite

CORDILLERA GOLF CLUB

Edwards, Colorado

Accepting new members.

Full Membership

Full Golf Membership – $70,000

2023 Annual Golf Dues – $14,995 ($1,000 Annual Food & Beverage Minimum)

Young Professional Golf Membership

Initiation Fee – $35,000 (2nd Half Due at age 45)

2023 Annual Golf Dues – $7,498

National Golf Membership

Initiation Fee – $35,000

2023 Annual Golf Dues – $7,498

Social Membership (Waitlisted)

Initiation Fee – $10,000

2023 Annual Social Dues – $3,650

RED SKY RANCH GOLF CLUB

Wolcott, Colorado

Accepting new members.

Full Membership

Initiation Fee – $140,000 (Payment Plan Available)

Annual Dues – $11,451

One Year Introductory Trial Membership

Activation Fee – $10,000 (Option to Upgrade Into Full Membership)

Annual Dues – $11,541

Legacy Membership

Annual Dues – $11,541

Must be a “vertically related” family member of a current members

Social Membership

Activation Fee – $25,000

Annual Dues – $3,000

Access to all non-golf facilities and events.

SONNENALP GOLF CLUB

Edwards, Colorado

Currently operating on a waitlist.

Sports Membership

Initiation Fee – $9,000

Monthly Dues – $344

Full Membership

Initiation Fee – $45,000 (Financing Plans Available)

Monthly Dues – $859

COUNTRY CLUB OF THE ROCKIES

Edwards, Colorado

Currently operating on a waitlist.

Full Membership

Initiation Fee – $200,000

Annual Dues – $18,500

Contact me for waitlist details!

What The Experts Are Saying…

Inflation. Interest Rates. Bank Failures.

It seems like the news cycle can be a picture of gloom and doom lately. And if you’re just reading the headlines, you may be rightfully concerned. Over the last two weeks, I’ve been involved in some interesting conversations, and I wanted to share another perspective.

The SVB collapse was directly tied to rising interest rates because they had a majority of their investments in treasury bonds which (as you know) have recently experienced a rate hike in response to rising inflation. As discussed in our recent company-wide meetings, there was bound to be a “pause” in rate hikes and then eventually a “pivot”, or reduction in the Fed rate. Perhaps this is the “pause” because, if it weren’t for the recent bank news, the Fed could have paused this month with no hike, but doing so would have sent the wrong message about the viability of our financial institutions.

A Note From John Palmer with Strategic Home Loans

“We’re seeing increasing evidence that inflation is slowing, the precursor to lower mortgage rates. Inflation is down 30% from the recent high of 9.1%. We’ve been waiting for this shift in the market ever since the Fed began their aggressive rate hikes last year. With the inevitable drop in rates, more buyers will begin to surface. Some have waited for prices to soften, which in our market may not happen. Others will qualify for their dream homes that they couldn’t qualify for when the rates rose so precipitously. There has never been a better time to buy a home, and those who act now (get at the front of the line) better position themselves to avoid another possible price escalation. I strongly believe that if you’re contemplating the purchase of a new home, you should act immediately (call Andie, your real estate professional, to discuss the market in depth).

The Fed is between a rock and a hard place. Chairman Powell and most Fed governors wanted to hold firm to their posturing that inflation is their top priority, and that they’d remain extremely aggressive in attacking inflation, yet the sudden series of bank failures, and the reality that more bank’s balance sheets are upside down, has led a growing number of economists and financial experts to beg the Fed to pause. However, because the market anticipated the .25% rate raise, no increase would have signaled a concern at the Fed level regarding our banking system’s fragility. The jury is split as to whether one more .25% raise will be announced, or if the Fed is done altogether, however either way we’re now heading in a very favorable direction.”

– John Palmer ([email protected])

Andie’s Real Estate Activity